Oil and shares slide as China protests hit markets – enterprise dwell | Enterprise

Key occasions

Filters BETA

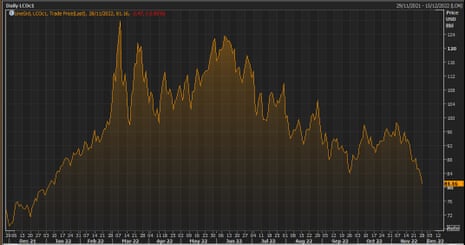

Brent crude oil hits lowest since January

Brent crude, the oil benchmark, has fallen nearly 3% to its lowest degree since January. as China’s Covid protests gasoline demand fears.

Brent is buying and selling at $81.48 per barrel, whereas US crude is under $75/barrel for the primary time in round 11 months.

Politcl uncertainty and the surge in Covid-19 instances in China are each weighing on the oil worth, which is a bellwether of development prospects.

Naeem Alsam, chief market analyst at Avatrade, says:

Principally, it’s demand that’s creating the principle subject for the value, and the truth that we’ve a possible recession menace and now the covid points in China, issues have gotten troublesome for oil merchants

The truth is that nobody needs to see extra lockdowns in China, as a scenario like this creates nothing however extra headwinds for oil costs.

Full story: Clashes in Shanghai as protests over zero-Covid coverage grip China

The wave of civil disobedience –- triggered by a lethal condominium fireplace within the far west of the nation final week –- is unprecedented in mainland China up to now decade.

My colleagues Helen Davidson and Verna Yu report:

Within the early hours of Monday in Beijing, two teams of protesters totalling at the very least 1,000 folks have been gathered alongside the Chinese language capital’s third Ring Street close to the Liangma River, refusing to disperse.

On Sunday in Shanghai, police stored a heavy presence on Wulumuqi Street, which is called after Urumqi, and the place a candlelight vigil the day earlier than was protests.

“We simply need our primary human rights. We are able to’t depart our houses with out getting a take a look at. It was the accident in Xinjiang that pushed folks too far,” mentioned a 26-year-old protester in Shanghai who declined to be recognized.

Introduction: Oil and shares hit by China protests

Good morning and welcome to our rolling protection of enterprise, the monetary markets and the world economic system.

World inventory markets are on edge because the protests intensify at main Chinese language cities in opposition to the nation’s stringent zero-Covid guidelines.

Shares have fallen throughout Asia-Pacific markets, whereas oil has dropped to a close to 11-month low, as public demonstrations in cities together with Shanghai, Beijing, Chengdu, Wuhan and Guangzhou pose a rising problem to president Xi’s zero covid insurance policies.

China’s CSI 300 share index fell sharply in early buying and selling, earlier than closing down over 1%. Hong Kong’s Grasp Seng is down 1.3% in late buying and selling.

European markets are set to open decrease, as concern grows over China protests and that i’s signature zero-Covid coverage.

In a single day, lots of of demonstrators and police have clashed in Shanghai, as frustration mounts practically three years into the pandemic.

The document rise in Covid-19 instances has added to public anger, explains Victoria Scholar, Head of Funding, at interactive investor:

“Uncommon protests have damaged out throughout main Chinese language cities in a backlash in opposition to the continued draconian zero-tolerance to Covid strategy from the authorities that has inhibited the freedoms of Chinese language residents because the begin of 2020 and that has sharply broken China’s financial development.

In consequence, worldwide buyers have grow to be much more cautious in the direction of China with the unrest weighing on the Shanghai Composite, the Grasp Seng Index and the Chinese language yuan in in the present day’s commerce.

In mid-November China diminished its quarantine time for worldwide journey by two days, suggesting that Beijing was lastly beginning to ease its strict lockdown measures and serving to to carry journey and on line casino shares amid optimism in the direction of the potential financial reopening.

Nevertheless that optimism has pale quick with China recording one other document excessive degree of covid infections on Monday, including to the sense of frustration after this weekend’s protests.

ASIAN MARKETS BRACE FOR IMPACT AS CHINA UNREST HITS SENTIMENT; ANYTHING EXPOSED TO CHINA IS ‘GOING TO BE VULNERABLE’: SAXO

— FXHedge (@Fxhedgers) November 28, 2022

With optimism about China’s restoration taking a knock, buyers are promoting out of shares and oil in favour of protected havens similar to greenback, yen and Treasuries.

Stephen Innes, managing companion at SPI Asset Administration, explains:

It definitely doesn’t assist when many are confined to their residences watching the World Cup, noticed 1000’s of mask-less followers in Qatar having fun with life that has lengthy been misplaced in COVID zero haze.

Social discontent may improve in China over the approaching months testing policymakers’ resolve to stay to the COVID zero mandates. And since China’s economic system is at present in a tug-of-war between weakening macroeconomic fundamentals and rising reopening hopes.

Mass protests would deeply tilt the scales in favour of a fair weaker economic system and certain be accompanied by a large surge in Covid instances, leaving policymakers with a substantial dilemma.

The agenda

-

11am GMT: CBI survey of UK distributive trades (retail trade)

-

2pm GMT: ECB president Christine Lagarde testifies to the European Parliament’s Committee on Financial and Financial Affairs

-

3.30pm GMT: Dallas Fed Manufacturing Index